Which of the Following Is Included in Comprehensive Income

These similar items include both net income and other revenue and expense items that are excluded from the net income calculation ie other comprehensive income Comprehensive Income Calculation. The components of comprehensive income are net income or loss plusminus items of other comprehensive income possibly including for a period.

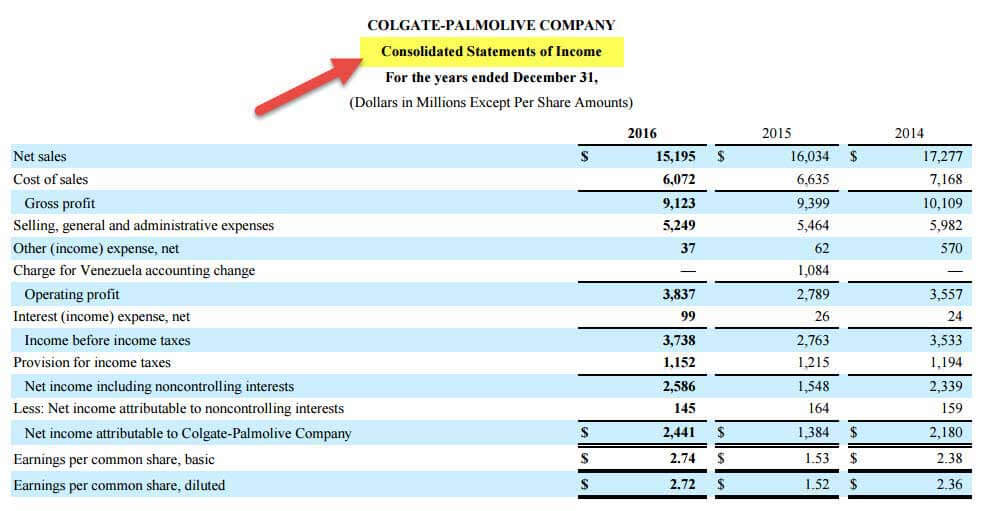

Statement Of Comprehensive Income Format Examples

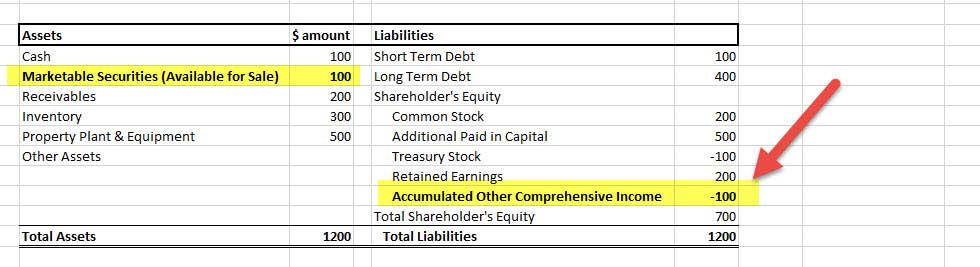

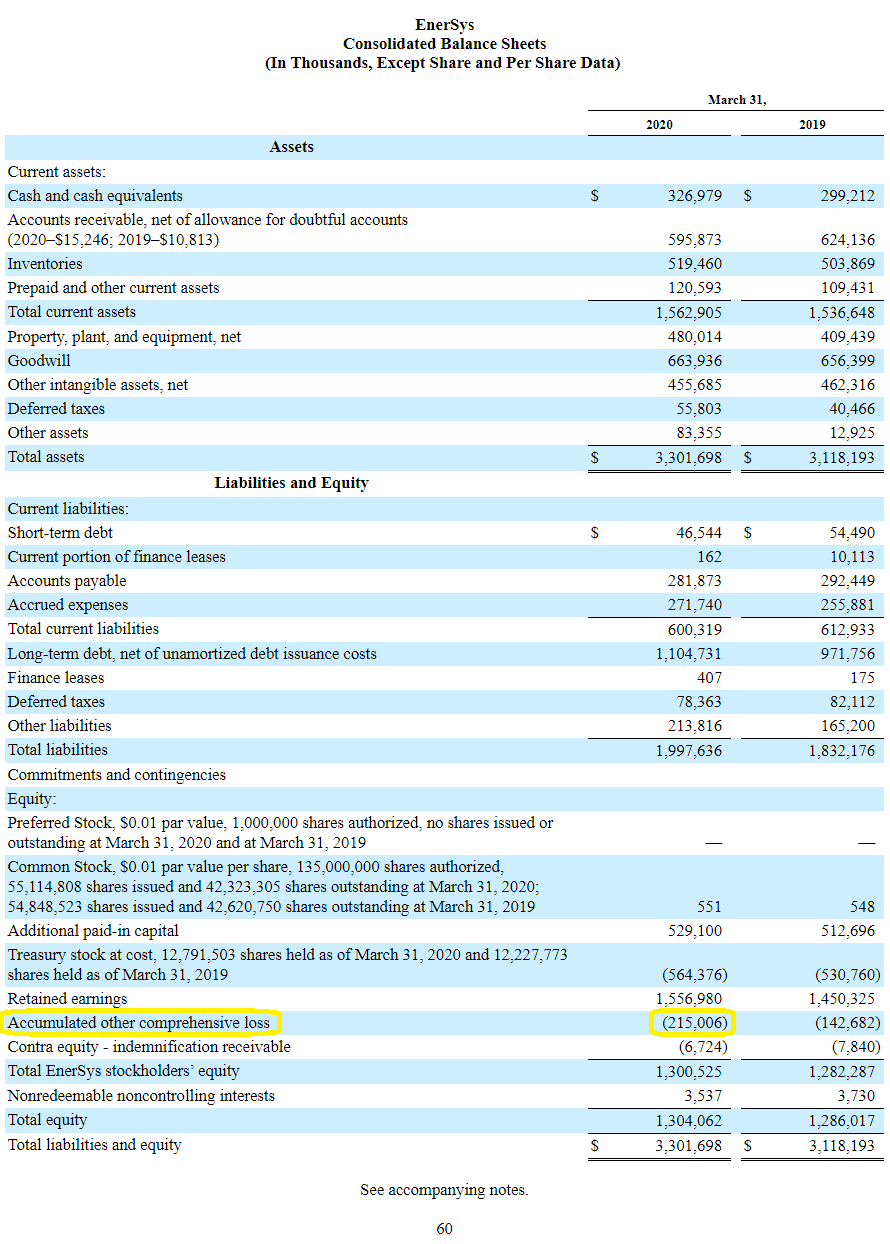

Other comprehensive income is shown on a companys balance sheet.

. Changes in accounting principles. Actuarial gain on defined benefit plan. Basically comprehensive income consists of all of the revenues gains expenses and losses that caused stockholders equity.

Receipt of land donated by a governmental unit. Which of the following is included in comprehensive income. Showing separately an analysis of expenses by function.

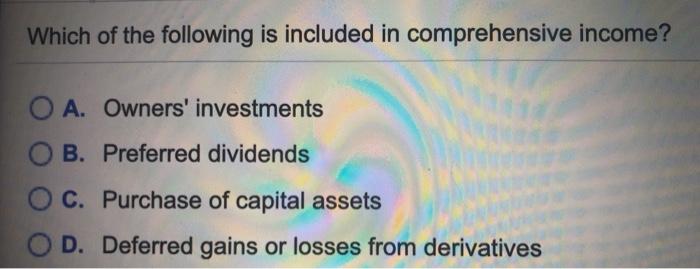

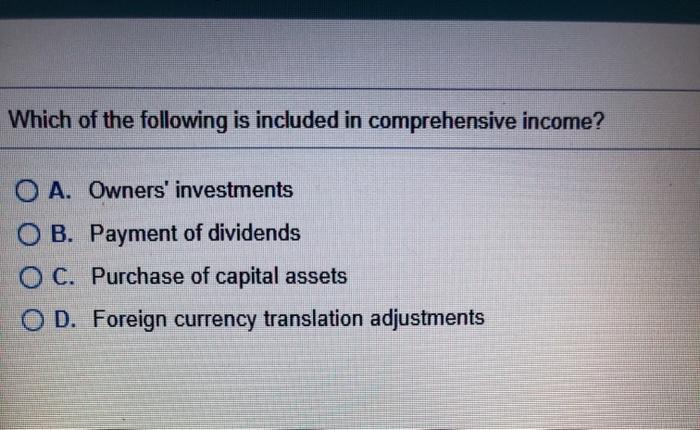

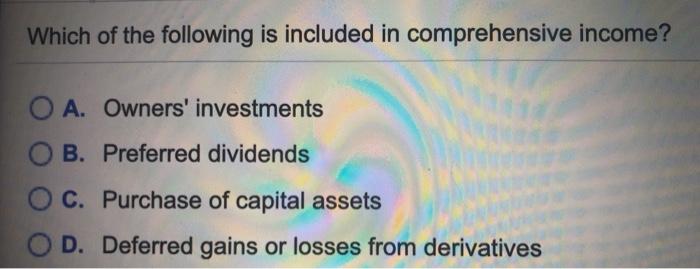

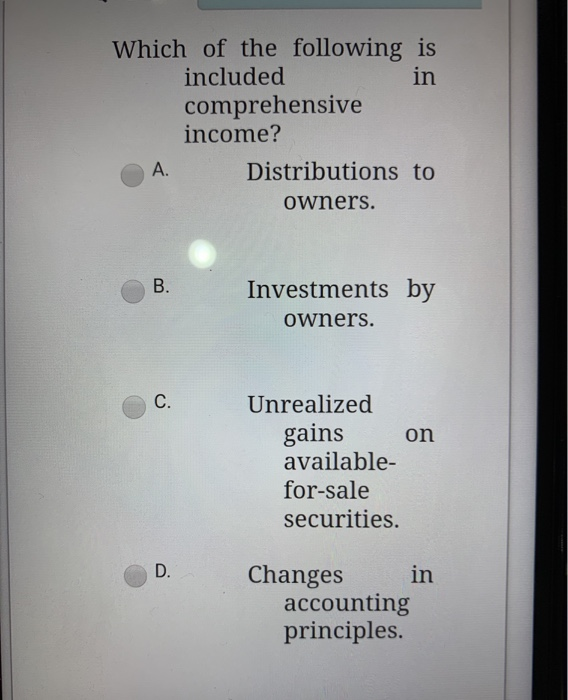

D Unrealized gains on available-for. Which of the following is included in comprehensive income. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized including items like an unrealized holding gain or loss from available for sale securities and foreign currency translation gains or losses.

Whereas other comprehensive income consists of all unrealized gains and losses on assets that are not reflected in the income statement. Showing separately profit or loss and the total of other comprehensive income. A Distributions to owners b Changes in accounting principles c Investments by owners d Unrealized gains on available-for-sale securities.

D gains and losses on equity investments. Unrealized gains on available-for-sale securities. Components of other comprehensive income.

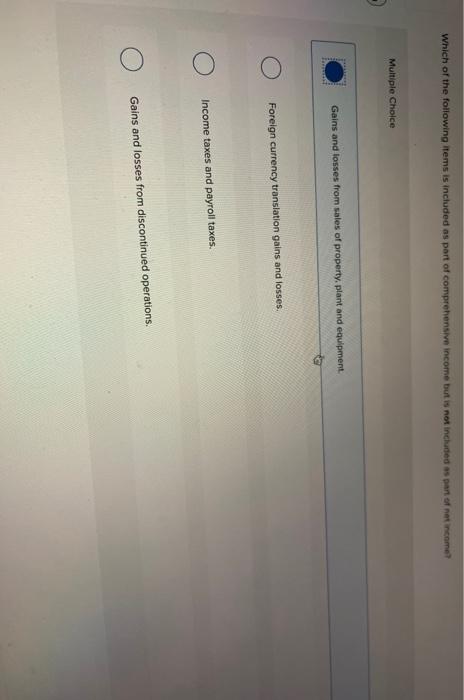

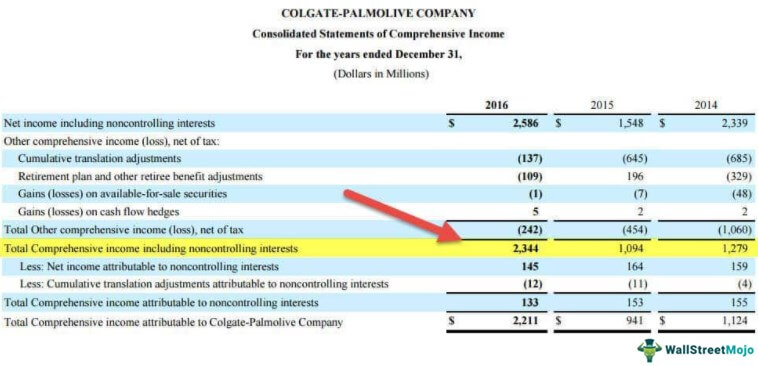

A a minimum pension liability adjustment b any unrealized gain or loss on available-for-sale investments c a foreign currency translation adjustment and gainloss on related hedge and d the effective portion. It is a more robust document that often is used by large corporations with investments in multiple countries. Unrealized gainslosses on postretirement benefit plans.

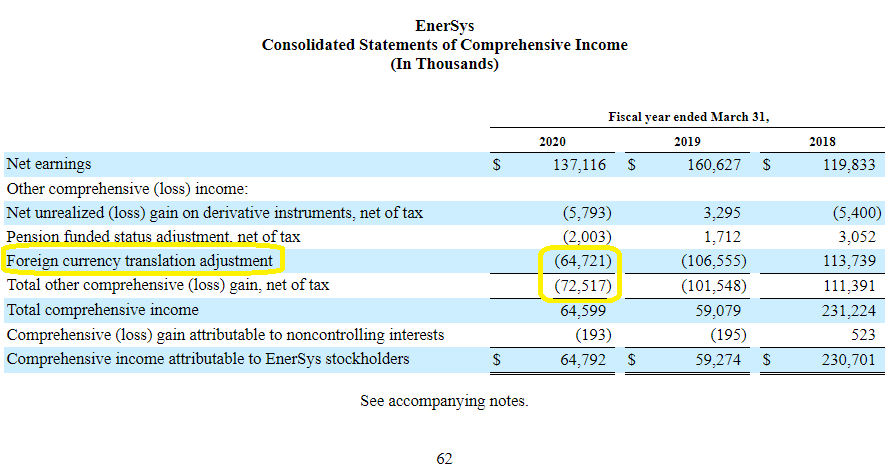

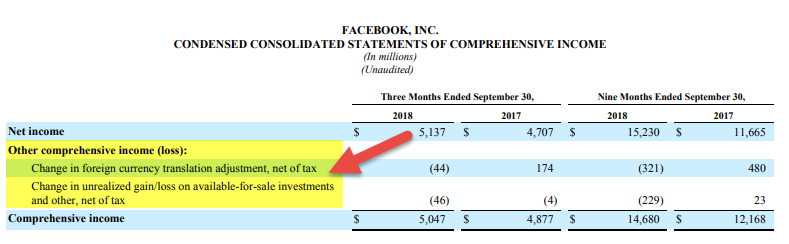

Unrealized gains on available-for-sale debt securities. B is corrent because the effects of foreign currency translation adjustments for the period are included in comprehensive income. Unrealized gainslosses on hedging derivatives.

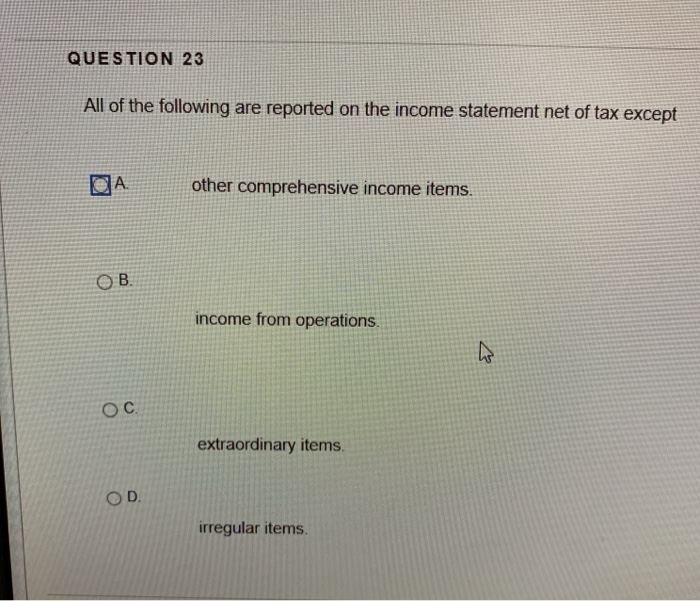

In other words comprehensive income includes the following. Foreign currency translation adjustments. Other comprehensive income contains all changes that are not permitted to be included in profit or loss.

Example of Comprehensive Income. It is particularly valuable for understanding ongoing changes in the fair value of a companys assets. The best way to demonstrate the computation of comprehensive income is the use of an an example.

Let me know if you run into any problems. Comprehensive income is the change in equity during a period resulting from transactions and other events other than changes resulting from transactions with owners in their capacity as owners. This helps reduce the volatility of net income as the value of unrealized gainslosses moves up and down.

C is incorrect because unrealized holding gains and losses from the reclassification of a debt security from available-for-sale to. A Owners investments B Purchase of capital assets C Preferred dividends D Deferred gains or losses from derivatives. Distribution to the owners.

Components of profit or loss. Showing separately an analysis of expenses by nature. Group of answer choices.

Which of the following is included in comprehensive income. Comprehensive income is a term that refers to the gains and losses that a company is yet to realize during its accounting period. Gains and losses on fair value through profit or loss FVTPL securities.

In business accounting other comprehensive income OCI includes revenues expenses gains and losses that have yet to be realized and. The options that are included in comprehensive income are. B contributions by owners Explanation.

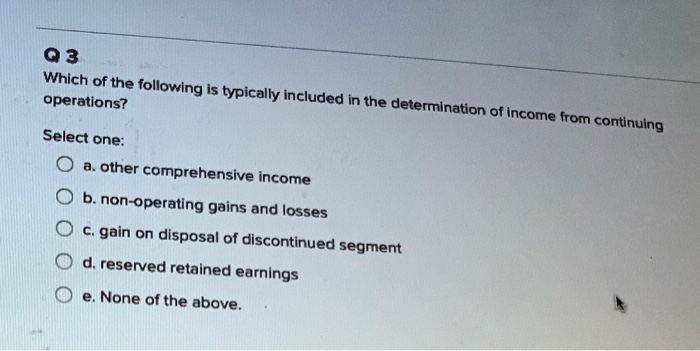

Multiple Choice Gains and losses on derivatives designated as cash flow hedges. B income tax expense. Changes in accounting principles.

Showing separately the total amount attributable to owners of the parent and the noncontrolling interest. Which of the following is included in comprehensive income. Other comprehensive income if any Examples of other comprehensive income include.

Other comprehensive income includes all of the following except. Unrealized profit available for sale on securities. Unrealized gains on available-for-sale securities.

It is similar to retained earnings which is impacted by net income except it includes those items that are excluded from net income. Unrealized gains resulting from remeasuring foreign currency financial statements of majority-owned subsidiaries to US. Unrealized gains and losses on translating financial statements of certain types of foreign operations.

Gains on sales of treasury stock. All of the following are included in comprehensive income EXCEPT a profit reported on the traditional income statement. Loss from translating the financial statements of a foreign operations.

Common items included in the account. A is incorrect because unrealized holding gains and losses on trading securities are included in income of the period. Either the nature of expense or the function of expens e.

Which one of the following is part of other comprehensive income OCI. Multiple Choice Sale of common stock above par. The gains losses revenue that are yet to be classified can be classified as comprehensive income.

Unrealized gains on available for sale financial asset. Which of the following items is NOT included in other comprehensive income. Which of the following is included in comprehensive income.

Asked Sep 23 2015 in Business by MedGal. Comprehensive income is the sum of net income and other items that must bypass the income statement because they have not been realized including items like an unrealized holding gain or loss from available for sale securities and foreign currency translation gains or. Comprehensive income includes net income and unrealized income such as unrealized gains or losses on hedgederivative financial instruments and foreign currency transaction gains or losses.

If an item listed in other comprehensive income becomes a realized gain or loss you then shift it out of other comprehensive income and.

Solved Which Of The Following Is Included In Comprehensive Chegg Com

Ifrs Example Financial Statements 2018 Annual Reporting

Statement Of Comprehensive Income Explained Accountingcoach

Solved Which Of The Following Items Is Included As Part Of Chegg Com

Other Comprehensive Income Oci Aoci The Basics With 10 K Examples

Solved Which Of The Following Is Included In Comprehensive Chegg Com

Other Comprehensive Income Overview Examples How It Works

Solved Q 3 Which Of The Following Is Typically Included In Chegg Com

Other Comprehensive Income Statement Example Explanation

Statement Of Comprehensive Income Overview Components And Uses

Solved Question 21 Comprehensive Income Would Not Include Oa Chegg Com

Solved Which Of The Following Is Included In Comprehensive Chegg Com

Statement Of Comprehensive Income Format Examples

Income Statements Explained Accountingcoach

Statement Of Comprehensive Income Format Examples

Statement Of Comprehensive Income Format Examples

Other Comprehensive Income Statement Meaning Example

Other Comprehensive Income Oci Aoci The Basics With 10 K Examples

Comments

Post a Comment